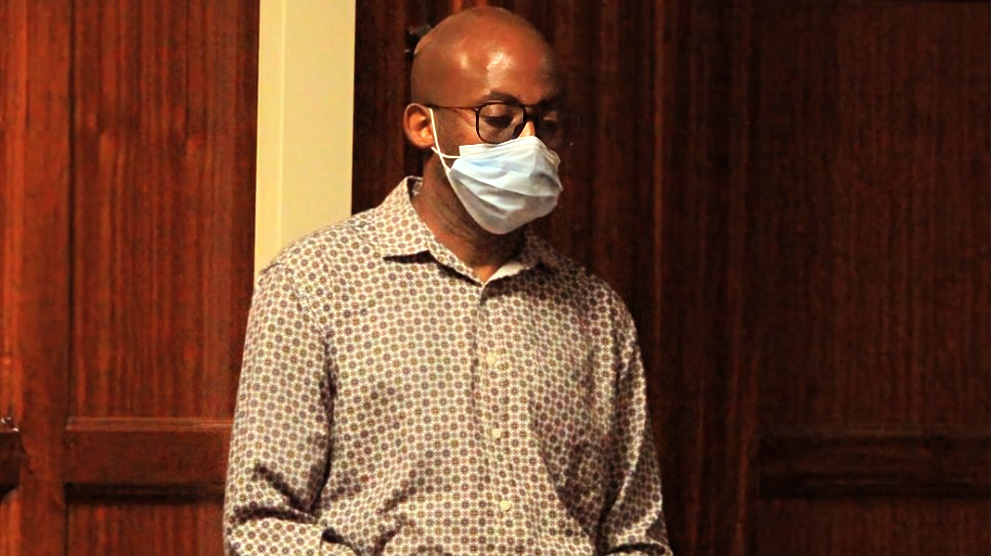

David Waweru Kamotho Faces KSh 8.9 Million Fraud Charge in Nairobi

A Nairobi businessman, David Waweru Kamotho, has been charged in court for allegedly tricking another businessman into paying him more than KSh 8.9 million. The case was mentioned before Milimani Chief Magistrate Lucas Onyina, where Kamotho denied all charges.

According to the charge sheet, the incident occurred on March 15, 2023, in Westlands, Nairobi. The prosecution claims Kamotho used a fraudulent trick to convince Kipngeno Obed Kigen to send him USD 70,200, equal to KSh 8,985,600.

The alleged deception involved a fake or misleading business deal. After receiving the money, Kamotho reportedly failed to deliver what was promised.

He was charged with obtaining money by false pretence, an offense under Kenyan law that carries heavy penalties if found guilty.

Appearing before the magistrate, Kamotho pleaded not guilty. His lawyer asked for bail, saying he was not a flight risk and had been cooperative during investigations.

The court agreed and released him on a personal bond of KSh 1 million. The case will be mentioned later for directions before a full hearing begins.

Kenya’s Penal Code defines obtaining money by false pretence as using lies or fake promises to make someone pay you. To convict, prosecutors must prove that the accused:

Made a false statement or trick,

Knew it was false,

Gained money because of it.

Kamotho, however, remains innocent until proven guilty. His defense insists it was a business misunderstanding, not a crime.

This case has drawn attention in Kenya’s business community. Many see it as a reminder to practice due diligence — verify contracts, check business partners, and avoid large payments without paperwork.

As the trial continues, it will show how Kenya’s courts handle high-value fraud and business deception cases.

For now, David Waweru Kamotho walks free on bond, awaiting his next court date. Whether he is guilty or not will depend on the evidence presented. But one thing is clear — this story is a strong warning about how easily trust and money can collide in business.